Ukraine’s privatized agriculture: A hungry guarantor of global food security

A farmer on his farmland in Western Ukraine. Image credit: CGTN.

Editor’s note: This is part one of a three-part series into how Canada and the broader West used a complaint post-Maidan coup government to privatize agriculture to the severe detriment of ordinary Ukrainians. This part focuses on how the overall privatization was set in stone, and functions now.

Written by: Peter Korotaev

Former Canadian ambassador to Ukraine Roman Waschuk said Ukraine is a country where the IMF does ‘economic experiments’. Ukraine is a laboratory for testing radical neo-liberal policies, irrespective of the harm ordinary Ukrainians face from them.

Of Ukraine’s 60 million hectares of land, 55 per cent (33 million ha) is considered arable – the highest such figure in Europe. Some more optimistic estimates place that figure at 74 per cent. The world average is 12.6 per cent. 2.3 per cent of the world’s arable land is in Ukraine. Much is often said of Ukraine as the ‘breadbasket of Europe’ – indeed, Ukraine’s arable land accounts for 25 per cent of Europe’s.

Things aren’t so rosy when it comes to Ukraine’s capitalist, privatized agriculture. While it exports plenty of sunflower oil and corn, food production has plummeted for decades, the land is monopolized by big agroholdings, the quality of the land is rapidly dropping because of unsustainable agroholding practices, and the population suffers from equal or worse levels of hunger as countries in Latin America.

The power of big agroholdings

Ukraine’s agricultural relations

In the 1990s, there was a privatization of the soviet state farm system. But in 2001, a moratorium was declared on the buying or selling of agricultural land. As a result, most Ukrainian agricultural land is still owned by small farmers. These small farmers numbered almost 7 million in 2019, or a sixth of the population. The remaining agricultural land is owned by the government.

The moratorium was introduced because many Ukrainian peasants were worried about losing their land to big business, especially to foreigners. Contrary to the urgings of domestic and foreign ‘market reformers’, most Ukraine’s peasants have no interest in privatizing their land. A 2005 survey showed that 96 per cent of Ukraine’s farmers did not want to start individual farming. A USAID poll conducted in 2015 showed that only eight per cent of landowners wished to sell it in the first year after the lifting of the moratorium, and a 2017 poll done by the institute of agrarian economics showed that only 10 per cent of landowners wanted to sell their land.

Until July 1, 2021, Ukrainian land could not be bought, but only rented. Due to the poverty of Ukrainian peasants, most (56 per cent) are forced to rent out their small plots to private companies. Another 29 per cent work the land themselves, 8 per cent rent it out to the government, and 7 per cent do nothing with their land. Many rent to larger companies – agroholdings. Land belonging to the government is also often rented out to big agroholdings. As a result, these agroholdings have played a dominant role in Ukraine’s capitalist agriculture.

The scale of agroholdings

The main Ukrainian agrobusiness web portal is fittingly called ‘latifundist’. Not only are Ukrainian agricultural relations often compared to those in Latin America, but Ukraine actually tops world figures in this respect.

Ukrainian largest agroholdings are very powerful. In 2017, two of Ukraine’s agroholdings were in the global top 20 list as ranked by amount of land controlled. NCH Capital, which evenly distributes its land in Russia and Ukraine, is in the top 10. Ukraine’s largest agroholding, Kernel, controlled 510 000 hectares of land in 2021. Kernel was planning to increase that to 700 000 after the ‘good news’ about Zelensky’s 2020 lifting of the moratorium on selling agricultural land. Kernel received $643 million of gross profit in the 2021 financial year, 5.2 times more than what it received in the previous year. This company alone is responsible for 22 per cent of Ukraine’s sunflower oil exports, 20 per cent of Ukraine’s grain exports, and close to 10 per cent of Ukraine’s total grain exports. Agroholdings were responsible for 22 per cent of Ukraine’s total agricultural production in 2017, though as we will see later, they have little to do with Ukraine’s food security.

It is hard to say how much Ukrainian land is controlled by large agroholdings, both because of non-transparency of these rental relations of control (relatively little Ukrainian land has been sold since the lifting of the moratorium) and the rapidly changing state of the sector. In its 2020 report, Land Matrix recorded 242 land deals (this includes rental and lease agreements) in Ukraine, leading to a total size of 3.24 million hectares under contractual control by agroholdings. This amounts to 7.6 per cent of all agricultural land and 10 per cent of all arable land.

But as Land Matrix itself admits, this is an underestimate since it only considers transparent deals.

According to ‘Latifundist’, in 2021, the top 117 agroholdings in Ukraine directly controlled 6.45 million hectares of land, which is 16 per cent of all agricultural land, and 20 per cent of all arable land. In 2020, according to ‘Eco-action’ and the Institute of Geography of Ukraine, only the top 10 agroholdings controlled 2.66 million hectares of arable land. According to the influential agrobusiness news portal ‘Landlord’, 45 agroholdings control 4.1 million hectares of arable land, with a total revenue of $10.8 billion USD.

By comparison, no EU countries apart from Romania (not coincidentally one of the EU’s poorest members) have large agroholdings. In most countries, such as Germany, no single individual or company owns more than 30 000 hectares of land, while the average size of agricultural plots is 20 hectares. Due to the negative social, economic and ecological effects of domination of agriculture by large agroholdings, only poor, imperialized countries in South America, Asia and Africa have agroholdings comparable to those in Ukraine[1].

How much land do foreign agroholdings control?

According to Land Matrix’s 2021 report, Ukraine is second on the global list of the amount of land owned by foreigners – three million hectares. Only beaten by Indonesia, Ukraine was followed by Russia, Papua New Guinea and Brazil. Another study found that 15 per cent of Ukraine’s agricultural land is owned by foreigners, or almost 20 per cent of arable land.

However, these figures are likely an underestimate. Latifundist writes that only 10 foreign agroholdings control two to three million hectares. The largest were US companies – the biggest two controlled 300 000 and 195 000 hectares. One of the ways that foreign businesses get around restrictions on owning land in Ukraine is by buying it as collateral from a Ukrainian bank. This method has also hugely discounted Ukrainian land through the use of the western program ‘Prozorro’, which we will detail in our last article.

Another reason why foreigners own more than it seems is given by Ukrainian economic journalist Roman Gubrienko. He writes that 60-70 per cent of the land controlled by agroholdings is actually foreign owned, albeit with a token Ukrainian front. A 2023 report on Ukraine’s agriculture found that nine out of ten of Kernel’s top shareholders are European or American. Ukraine’s fourth largest investor in 2020 was Norway’s Sovereign Wealth fund, which owns shares in both Kernel and its competitor agroholding MHP. Blackrock and Goldman Sachs are some of the other big global financial groups heavily involved in Ukraine’s agriculture.

Indirect relations of control by agroholdings

It is also misleading to only take into account direct juridical control over land through rental contracts. This does not take into account the indirect control over agricultural produce effected by the domination by big agroholdings of agricultural capital goods. While financially out of reach of the poor individual farmers that nominally own most Ukrainian land, big agroholdings own most processing, logistics, elevator and storage equipment. Without the appropriate equipment, peasants are forced to sell their produce for very low prices. Since trading companies and agroholdings own two thirds of all agricultural elevator equipment, they can easily force smaller peasants to sell them produce for low prices, then resell it abroad for higher prices.

Kernel is not only the biggest agroholding but also the biggest trader of agricultural produce – it was responsible for delivering 13 per cent of all Ukraine’s grain exports in 2019-20. The top three traders were responsible for delivering 30 per cent of Ukraine’s exports. The top five private owners of elevators control a third of all elevators. Kernel is also the biggest private owner of elevators. This means that in some regions, agroholdings such as Kernel enjoy a monopoly on elevators.

As a result, agroholdings can dictate prices to smaller peasants, and in reality, control far more of the agricultural industry than indicated by the land they legally control. These indirect means of control are why Natalia Mamonova, an academic specialized on the topic, wrote in 2015 that 60 per cent of Ukrainian agricultural land is controlled by big agrobusiness.

Privileged giants

The agroholdings have political power to match their economic strength. Through their lobby, the ‘Ukrainian Club of Agrarian Business’ (UCAB), they advocate for laws that raise taxes on small farmers. While the similar law 3131 failed to pass through parliament (Verkhovna Rada – VR), law 5600 was approved by president Zelensky in December 2021. This law involved increasing the tax burden on small and medium farmers. The VR expert committee critiqued the law, arguing that it ignores the seasonal specificities of various forms of agriculture and that it is based on the unproven assumption that small farmers avoid paying taxes.

According to the VR expert committee:

‘increased tax pressure on small producers may lead to the sale or lease of land by them (which may be one of the negative consequences of the adoption of the project) and lead to an increase in unemployment in rural areas, an outflow of labor to cities and abroad, a decrease in competition and monopolization of agricultural production, changing the structure of agricultural production, the commodity structure of export-import, increasing the price offer in the domestic agri-food market, etc’

The government made agricultural liberalization its top priority, regularly describing the 2020 privatization of land as one of its greatest achievements. As Zelensky put it in a 2020 pathos-laden speech to farmers (where he promised meagre credits), ‘without land reform, we have no chance to become the breadbasket of Europe’. The head of the Servant of the People party, David Arakhamia, sung praises to law 5600, pushing parliament hard to ratify it as soon as possible, despite expert critique. Taras Vysotsky, Deputy Minister of Economic Development, Trade and Agriculture and a top advocate of market reforms, was general director of UCAB until 2019.

It is hence no surprise that while the government implements laws impoverishing Ukraine’s 2.3 million small or medium farmers, it approves huge subsidies for big agroholdings. In January-September 2017, Ukraine’s largest poultry agroholding and third largest landowner, MHP (belonging to Yury Kosyuk), received 1.25 billion hryvnias in ‘agrarian support’ subsidies from the Ukrainian budget. By comparison, the 2017 budget involved 1 trillion hryvnias in spending. Kosyuk was also an advisor to then-president of the time Poroshenko, and the sixth richest Ukrainian ($900 million). Independent journalists also found that Kosyuk was a key intermediary figure in immense Donbass smuggling schemes linking US diplomat Kurt Volker and Poroshenko. The company, like any agroholding and most Ukrainian big business, has its headquarters in Cyprus (previously in Luxemburg). That means that not only does it receive enormous budget subsidies, but it evades taxes. In 2019, the company announced that it would make new investments in the Balkans and Saudi Arabia instead of in Ukraine.

MHP received $230 million USD (6.2 billion hryvnia) in pure profits in 2017. In 2018, Kosyuk’s company received 25 per cent of all state agricultural subsidies, 970 million hryvnia. In 2018, the government approved a law giving big agroholdings (before this was only possible for small farmers) the right to receive compensation from the government for credit interest.

The second most privileged company was UkrLandFarming, which owns the second largest amount of agricultural land after Kernel); receiving 444 million hryvnias. This company and MHP combined received half of all agrarian subsidies in 2017. The same year, according to state statistics, MHP received 1.8 billion hryvnia in subsidies. Two companies belonging to members of Poroshenko’s parliamentary bloc received a total of 3.5 million hryvnias, the same amount of money spent on the modernization of the streetlights of the entire city of Khmelnytsky. 60 milion hryvnia were also received for the agricultural business of a deputy of the Verkhovna Rada belonging to the parliament’s Agrarian Committee .Even the pro-western ‘radiosvoboda’ who conducted this investigation reported that it is possible that the real numbers are higher.

Apart from state subsidies to Poroshenko allies like Kosyuk, avoiding taxation is itself a form of subsidy. And this is exactly what Zelensky legislated in 2021, signing off a reduction in value-added taxes from 20 per cent to 14 per cent for imports and exports of a variety of top agricultural exports, including agroholding favorites corn, sunflower, and wheat.

Ukraine’s agrobusiness is very low down the list of top Ukrainian taxpayers, a list which itself is hardly full of high performers. The top agricultural tax payer is Kernel, which was still only at 147th place in 2020. It paid only $18 million in taxes in 2018. The same year, Kernel earned $513 million USD in profit, and its owner was among Ukraine’s top 20 richest men. MHP paid even less.

According to the NGO Ukrainian Agrarian Association, only a fifth of designated state assistance to small-scale farmers reached its destination in 2018, for a total of merely $7.4 million USD. The World Bank gave only $5.4 million in support to small Ukrainian farmers. Even this small amount did not come from the WB itself, as is the case for its loans to big agrobusiness, but required small farmers to use their future harvests as collateral to receive capital. It and other western financial institutions have found it much more important to push for the agricultural liberalization which destroys small farmers and encourages the growth of big agroholdings. We will look closer at the role of western financial institutions in encouraging the rise of big agrobusiness at the cost of smaller farmers in the final article of this series.

Analysts of Ukraine’s agricultural relations have also noted how difficult it is for smaller farmers to receive credit. Banks mainly work with clients that own over 500 hectares of land, and require extensive paperwork, as well as generally being short-term and involving high interest rates.

The decline of agricultural employment

The post-Soviet period has seen a steady decline in the amount of agricultural land controlled by family farmers. This is because the defunct Soviet Union provided large subsidies to peasants, buying much of their produce and organizing other aspects of production. The world bank, on the other hand, stated that the key to development of Ukrainian agriculture through privatization is ‘expansion of producers with higher productivity and incentives for lower productivity producers to improve or exit, as the price of land rises.’.

The more that agricultural relations has been liberalized, the more rural employment has declined. Slightly rising from 2012-13, it drastically fell from 3.3 million to 3 million in 2013-14. Declining every year since, by 2021 only 2.69 million people were employed in agriculture. It is hence no surprise that most Ukrainian farmers have consistently stated their unwillingness to become individual, capitalist farmers.

Kernel, Ukraine’s biggest agroholding, controls 500 000 hectares of land, about 1.5 per cent of Ukraine’s arable land, but only employs 15 000 workers. That means that if all Ukraine’s arable land were used by agroholdings similar to Kernel, only 990 000 workers would be needed. Given the fact that agroholdings employ quite few people, the decline in agricultural employment is certainly thanks to increased unemployment among individual farmers. While total employment fell, from 2014 to 2021 Ukraine increased annual exports of agroholding favorite sunflower oil from 12 million to 16 million tons.

The controversial privatization of agricultural land

Unpopular reforms

The marketization of Ukrainian agriculture has always been very unpopular. According to one 2020 poll, only 15 per cent of Ukrainians supported the privatization of agricultural land. Nevertheless, under cover of Covid quarantine restrictions on public meetings, during the same year, Zelensky lifted the moratorium on the buying and selling of agricultural land. Zelensky never ceases to remind western state audiences of this act to prove his credentials as a 'defender of free market democracy’. It is well known and readily admitted by pro-privatization Ukrainian outlets that the lifting of the moratorium was due to IMF pressure.

The aforementioned makes it difficult to describe the lifting of the moratorium as particularly ‘democratic’. On the topic of democracy, Kernel has been accused of ‘raider’ captures of land, whereby they threaten or otherwise force small farmers to sign over the rights to their land. In 2016, 7150 cases of raider captures of agricultural land were recorded.

Roman Leschenko, minister of agrarian policy and food, had much to say about the necessity of land reform. While claiming that Ukrainians were ‘intimidated and misled’ into opposing the privatization of agricultural land, he was very pleased by the ‘historic’ decision to privatize the land in 2020. But he lamented that this law remained ‘highly conservative’. What he meant by this was the fact that the 2020 law did not allow foreigners to buy land – this question would be decided on no earlier than 2024.

But Ukrainian journalist Roman Gubrienko brought up the fact that several months later, there was an amendment to the law allowing foreigners to buy the land through using it as banking collateral. Even the most unpopular part of agricultural land reform – allowing foreigners to buy land is opposed by 81 per cent of Ukrainians - thereby went through quite easily, despite Leschenko’s fears. Even without the loophole, foreigners still had fairly easy access to the land – companies with US, Saudi, and European companies control millions of acres.

The price of land

In 2020, Ukrainian economy minister Taras Vysotsky predicted that the average price per hectare of Ukrainian land would be between $1480-$2224. But quite different estimates emerged from various government figures, ranging from $1000-$2500 per hectare. Vysotsky also ‘predicted’, or threatened as Ukrainian journalist Gubrienko puts it, that the price of land will fall from $2200 to $1500 if there are ‘restrictions’ on the privatization process, such as on the size of land per owner or on foreign investors. Meanwhile, all these predictions are very far from the minimal price of $8000-$10,000 per hectare of Polish land, which had been used for years to tempt Ukrainian farmers to agree to privatization. Land in western European countries costs $30,000-$64,000 per hectare.

In January 2020, Gubrienko predicted that land would be sold for even cheaper. He based this off poll results from 2019 which showed that Ukrainian land generally earns about $130 a month for its owners. As a result, he predicted prices at best of $1000-$1200 per hectare. Gubrienko predicted that the increase in supply of land would further drive down the price. The state also owns 7-10 million hectares of agricultural land and stated that it plans to receive over $1 billion from land sales in 2020. The difficulty of securing credit in Ukraine due to harsh IMF banking reforms is cited by him as another factor driving down land prices. The low quality of Ukrainian soil is another factor, itself a result of intensive cultivation of monocrops by agroholdings.

In the first three months after the land market was opened, the average price per hectare was $1690. The lowest average was in the Kherson region, at only $830. However, the process was non-transparent – these averages only take into account 54 per cent of sales.

The liberal publication Liga promises that the price will rise in the future. It also includes calculations given by an EU-sponsored think tank ‘Land Transparency’ in cooperation with a World Bank official, according to which any restrictions on the concentration of land ownership or on foreign control over land will lead to a slower rate of Ukrainian GDP growth and a slower rate of growth in land prices. In the most unregulated scenario, Ukraine would supposedly gain $10 billion. Tymofiy Mylovanov, a notoriously neoliberal advisor to the president’s office, promised that land privatization would increase GDP by 1.5 per cent per year.

The same Liga publication records that three months later (January 2022), the average price of land had fallen to $1500 per hectare. While the article does not mention this, the threat of war likely played a role here. Nevertheless, in the midst of the anticipation of war (December 2021), the economy minister promised that the price of Ukrainian land would rise to $2200 by 2-3 years. Faith in the market knows no bounds.

Agricultural trade with the EU

Western nations and domestic agricultural latifundists ceaselessly pushed on the Ukrainian government government to lift the moratorium on buying and selling agricultural land. This move gave power to big agroholdings. These companies, which decide on what to invest in based on the price trends in top export markets like that of the EU, set about deepening Ukraine’s neocolonial trade relation with the EU. Where the EU sells Ukrainian agrobusiness means of production and processed food goods, Ukraine sells back cheap agricultural raw materials.

Illusions and reality of ‘eurointegration’

Ukraine’s modern history has been transformed by the question of signing a free-trade agreement (FTA) with the EU. This was generally misrepresented by its supporters as being equal to joining the EU.

All kinds of promises were made about the magical results of the FTA. It was said byv supporters such as Maidan Prime Minister Yatsenyuk (of Victoria Nuland phone call fame) to bring instant economic prosperity. They would often refer to the pension and wage levels of Germany as an obvious disproval of all the ‘Eurointegration’ doubters, who reasonably pointed to the deindustrializing effects of giving EU capitalists access to the Ukrainian market, and the inherently unequal terms of the agreement. Yatsenyuk and the other ‘principled supporters of Eurointegration’ (generally urban journalists on western grant money who had never stepped foot in a factory) always loved talking about how ‘integration with the EU will give Ukrainian exporters access to the biggest market on earth’.

The problem is that this was always explicitly contradicted by the actual FTA, which entered into practice in 2016. It involves harsh quotas for Ukraine’s top exports. This means that only a comparatively small amount of Ukraine’s exports can actually reach the EU without paying tariffs, while the much stronger (and highly state-supported) European producers are free to invade the Ukrainian market.

2019 was post-Maidan Ukraine’s best trade year[2], but exports to the EU only increased by 3 per cent. During the 2020 Covid pandemic, while the EU tightened access to its markets, it forbade Ukraine from taking any steps to protect its markets. As a result, exports to the EU tumbled by 13.2 per cent.

Ukraine’s total exports in 2019 were only $63.5 billion according to the World Bank – in 2012, they were $86.5 billion. Industrial exports to the EU even declined by 2.3 per cent. While Ukraine’s total vegetable exports increased from $6.6 billion USD to $17.6 billion USD in 2010-2020, its machine and transport equipment exports decreased from $9.1 billion USD to $5.4 billion. Exports to Europe accounted for only $3 billion USD of the increase in vegetable exports – China and other countries of the ‘barbaric East’, so reviled in the hegemonic post-maidan Ukrainian discourse, are responsible for much of its export growth. The sluggish growth of exports to the EU has not been enough to compensate for the loss of the Russian market for industrial goods, and for a general decline in exports due to FTA-induced deindustrialization.

Programmed inequality of the EU Free Trade Agreement

In 2021, the five-year period approached when Ukraine was entitled to renegotiate the EU FTA. Something approaching negotiations on the topic took place. To which the EU answered, as usual, that there could be no such relaxations in trade relations until Ukraine tried harder to implement reforms demanded by the EU. The reforms demanded by the EU, such as the ‘struggle against corruption’, invariably involve removing support for Ukrainian industry.

The EU representative declared that Ukraine would receive neither full access to the EU market of state purchases, nor a relaxation in the quota regime. Things only changed in 2022, when Ukraine’s industry became largely destroyed by war – then the EU declared that Ukraine could have tariff free access to EU markets for a limited period.

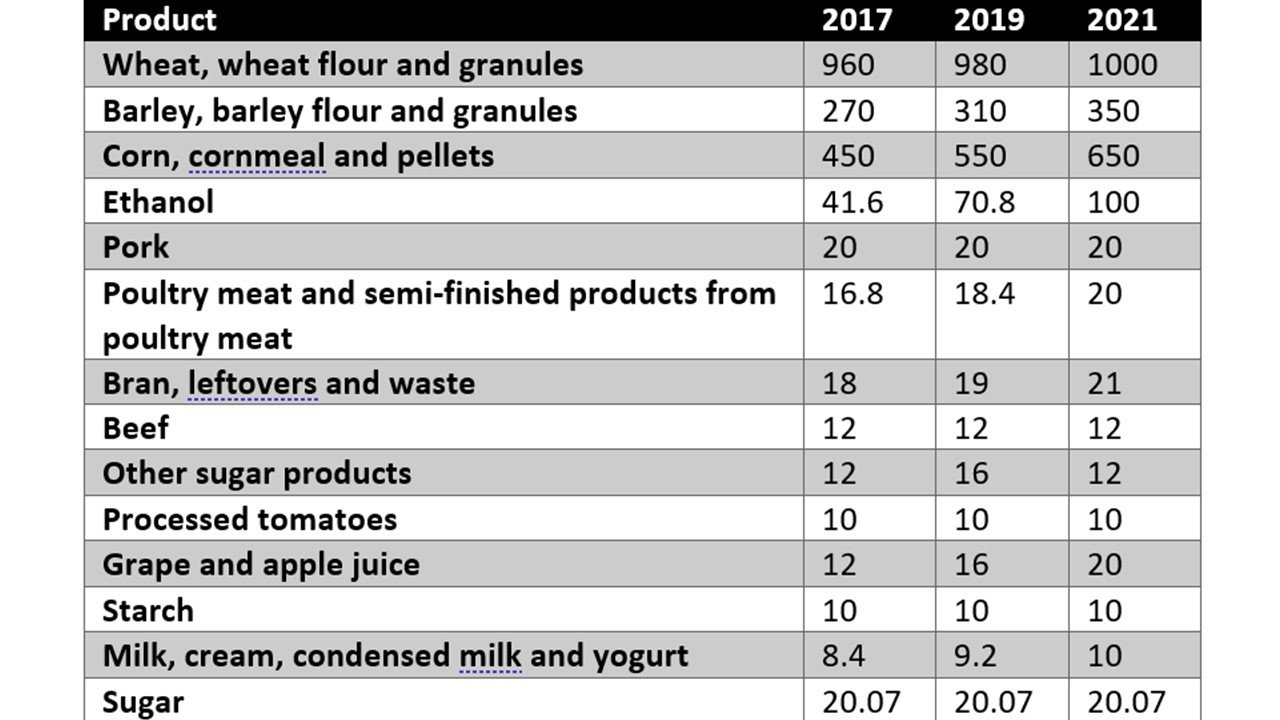

What are these tariff quotas? The 2016 FTA gave tariff-free access to 36 (+4 extra) groups of Ukrainian exports. Only agricultural exports received this privilege. Occasional noise about tariff-free access for Ukrainian industrial goods never came to anything until 2022. The FTA involved a small increase in some of these quotas over time. The following table shows the change over time of these tariff-free quotas for only those exports whose yearly volume exceeded 10,000 tons.

Size of tariff quotas for main Ukrainian exports to the EU, 2017-2021 (thousands of tons).

These quotas are highly restrictive. In 2021, Ukraine exported to the entire world 42 times more wheat than allowed the EU quotas, and 21 times more than the EU quotas. The EU imported 18.5 times more corn from Ukraine than what the quotas allowed. This is despite the fact that Ukraine is indeed a crucial source of grains for the EU – the second biggest source after France, accounting for 14 per cent of total EU imports of corn, wheat and other grains.

While Ukraine exported 81 000 tons of honey in 2020, it is only allowed six thousand tons by the 2021 quotas. The milk quotas allowed by the FTA were only 0.007 per cent of total Ukrainian production, while Ukraine produced 66 times more meat than allowed by the quotas in 2015. In 2019, while Ukraine exported 414 000 tons of chicken meat, it was only allowed 19 200 tons of customs-free exports to the EU. As Ukrainian chicken magnate Yury Kosyuk said:

“There has been no opening of the [EU] market. You know, there is a mechanism in the wheel called a spoke nipple. It allows something to pass in one direction, but not to pass in the other direction. This is approximately the situation we now have with the European markets. Europe talks about a free trade zone with Ukraine, and at the same time a bunch of exceptions and restrictions have been put in place for the export of Ukrainian goods... while we produced 1.2 million tons of chicken meat in 2016, anything over the 16-000-ton quota is charged with a tariff rate of more than 1000 euros a ton... Ukraine has been tricked by this ‘free trade agreement’’“

The story with restrictive quotas can be continued extensively. Ukraine also regularly exceeds quotas for juice, tomatoes, and cereals.

Even these meagre benefits are only given to primitive agricultural goods. Ukraine has had no luck in receiving any such privileges for its industrial goods. It is worth mentioning some impressive figures brought up by a 2020 report by the ministry of economy, as part of its ill-fated drive to implement state support to domestic industry (subsequently halted by the EU):

“the production of motor vehicles in 2019 amounted to only 31.0 per cent of the level of 2012, the products of the railcar industry - 29.7 per cent, the production of machine tools - 68.2 per cent, metallurgical products - 70.8 per cent, agricultural engineering products - 68.4 per cent”...

“Between 2013-2019, exports of aerospace products decreased by 4.8 times (from $1.86 to $0.38 billion), production of railcar products - by 7.5 times (from $4.1 to $0.5 billion), production in the metallurgical sector - by 1.7 times (from 17.6 to 10.3 billion US dollars), chemical products - by 2.1 times (from 4 to 1.9 billion dollars)"

On the other hand, after a three-year transition period, Ukraine was obliged by the FTA to remove import tariffs on a range of EU imports in 2019. In 2016, the Ukrainian government had agreed to totally remove or reduce import tariffs for most EU imports within three to 10 years. The EU only exceeded one export quota to Ukraine in 2017 - chicken meat. It only used 5 per cent of its pork export quota, and 0.5 per cent of its sugar quota.

Other forms of EU agricultural protectionism

Besides the quotas, the EU FTA also obliges Ukraine and the EU to ‘refrain from any state subsidies’ for exports. In conditions where Ukrainian agriculture is far weaker than EU, while the EU hypocritically gives immense subsidies to its farmers, this has naturally led to domination by EU imports and decline of Ukrainian production.

Another form of hidden protectionism is the EU’s stringent restrictions on food imports. Due to various ecological and quality controls, many Ukrainian exports cannot enter the EU. This is one of the main reasons, along with the tiny quotas, that Ukrainian agricultural exports have been forced to reorient towards Asia and Africa.

Neo-colonial trade relations

Along with a huge trade deficit, the EU sells Ukraine processed goods, while Ukraine exports cheap raw materials. A good example of the primitive nature of Ukraine’s agricultural sector is Ukraine’s tractor trade. While it exported $4.7 million worth of tractors in 2020, it imported $456 million. 59 per cent of those tractors were imported from the EU, and another 12 per cent were from the US and UK. The rich first world imports cheap food goods from Ukraine, extracting large tariff revenues in the process, and sells Ukraine the industrial machinery needed for this agriculture.

For instance, Ukraine’s main exports to the EU in 2021 were iron and steel (20.8 per cent of total exports), ores, stag and ash (12.5 per cent), animal and vegetable fats and oils (8.5 per cent) – mainly sunflower seed oil, electrical machinery (7.8 per cent) and cereals (7.3 per cent). ‘Electrical machinery’ is actually mostly just the manual screwing together of wires in small sweatshops as part of European car production chains. The EU’s main exports to Ukraine were machinery (14.8 per cent of all exports), transport equipment and vehicles (10.2 per cent), mineral fuels (9.4 per cent), electrical machinery (9.3 per cent), and pharmaceutical products (5.9 per cent).

European exporters have actively entered and mastered the Ukrainian market. In 2019, the Ukrainian destination set a record for growth in European food exports. Ukraine took third place in the ranking of consumers of agricultural products from the European Union. In the first half of 2019, the EU increased agricultural exports by 15 per cent compared to 2018, reaching 2.26 billion euros. In 2020, Ukraine imported 1000 times more butter from the EU than it exported. In 2021, Ukraine had an overall trade deficit of over 4 billion euros with the EU.

Domestic producers are losing competition and shelf space to European manufacturers. Unlike Ukraine, producers in Europe are protected by high duties, tight quotas and receive huge subsidies from the general budget of the European Union. Ukrainian economic journalist Roman Gubrienko argues in his articles on the topic that the rapid advance of imported food products leads not only to the capture of the market and the displacement of Ukrainian agribusiness, but also gradually destroys the basis of domestic food production - the topic of the next article.

Notes

[1] Australia being a notable exception.

[2] 2021 had higher export figures in dollars, but this was due to post-covid global price rises on raw materials exported by Ukraine.

Editor’s note: The Canada Files is the country's only news outlet focused on Canadian foreign policy. We've provided critical investigations & hard-hitting analysis on Canadian foreign policy since 2019, and need your support.

Please consider setting up a monthly or annual donation through Donorbox.

Peter Korotaev writes on political movements, class relations, and economic policy in Ukraine. You can follow his work on his substack, "Events in Ukraine".

More Articles